All Categories

Featured

Table of Contents

There is no payment if the plan ends before your death or you live past the plan term. You may be able to restore a term policy at expiry, but the premiums will be recalculated based on your age at the time of renewal. Term life insurance coverage is typically the the very least pricey life insurance policy readily available due to the fact that it provides a death advantage for a restricted time and does not have a money value part like long-term insurance coverage.

At age 50, the costs would climb to $67 a month. Term Life Insurance coverage Rates 30 years old $18 $15 40 years old $28 $23 50 years old $67 $51 Resource: Quotacy. Quotes are for a $250,000 30-year term life policy, for guys and females in exceptional health.

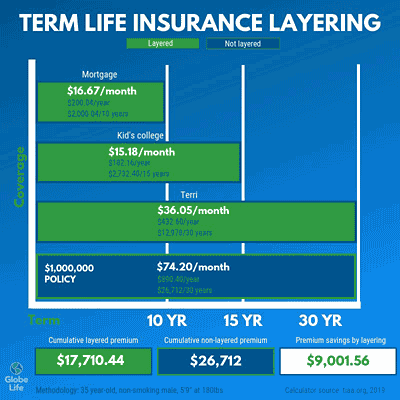

The reduced risk is one aspect that permits insurance firms to bill reduced premiums. Passion rates, the financials of the insurance provider, and state laws can additionally affect costs. In general, business commonly offer far better prices at the "breakpoint" protection levels of $100,000, $250,000, $500,000, and $1,000,000. When you take into consideration the amount of coverage you can obtain for your costs bucks, term life insurance policy often tends to be the least expensive life insurance.

He gets a 10-year, $500,000 term life insurance plan with a premium of $50 per month. If George dies within the 10-year term, the policy will certainly pay George's beneficiary $500,000.

If George is detected with a terminal illness during the first policy term, he probably will not be qualified to restore the policy when it expires. Some policies provide ensured re-insurability (without proof of insurability), however such attributes come with a greater cost. There are numerous kinds of term life insurance.

Most term life insurance has a degree costs, and it's the type we've been referring to in many of this article.

Reliable A Renewable Term Life Insurance Policy Can Be Renewed

Term life insurance policy is eye-catching to young people with children. Moms and dads can get significant protection for an inexpensive, and if the insured passes away while the policy is in result, the household can count on the fatality benefit to change lost earnings. These policies are likewise fit for individuals with expanding households.

Term life plans are suitable for individuals who want considerable coverage at a reduced expense. Individuals that possess entire life insurance policy pay a lot more in costs for much less coverage however have the safety of understanding they are safeguarded for life.

The conversion rider need to permit you to convert to any kind of permanent plan the insurer supplies without restrictions. The main attributes of the rider are preserving the initial health and wellness score of the term policy upon conversion (also if you later have health and wellness problems or come to be uninsurable) and determining when and just how much of the protection to transform.

Obviously, overall costs will increase dramatically given that whole life insurance policy is more pricey than term life insurance. The benefit is the assured approval without a medical test. Medical conditions that develop throughout the term life period can not trigger premiums to be raised. However, the company may need minimal or complete underwriting if you intend to include added cyclists to the brand-new plan, such as a long-lasting care rider.

Whole life insurance comes with substantially greater monthly premiums. It is indicated to supply protection for as long as you live.

Value Guaranteed Issue Term Life Insurance

Insurance coverage firms set a maximum age limit for term life insurance policy policies. The premium also climbs with age, so an individual aged 60 or 70 will pay substantially even more than someone decades more youthful.

Term life is rather similar to car insurance. It's statistically not likely that you'll need it, and the premiums are money down the tubes if you don't. However if the most awful happens, your household will get the advantages.

One of the most preferred kind is now 20-year term. A lot of business will certainly not market term insurance coverage to an applicant for a term that finishes past his or her 80th birthday celebration. If a plan is "eco-friendly," that suggests it proceeds active for an added term or terms, approximately a defined age, also if the health of the insured (or other variables) would certainly trigger him or her to be rejected if he or she requested a brand-new life insurance plan.

So, premiums for 5-year sustainable term can be degree for 5 years, after that to a brand-new price mirroring the brand-new age of the guaranteed, and so forth every 5 years. Some longer term policies will certainly guarantee that the premium will certainly not increase during the term; others do not make that guarantee, making it possible for the insurance business to elevate the rate during the plan's term.

This means that the plan's proprietor deserves to change it right into a permanent kind of life insurance policy without extra proof of insurability. In most kinds of term insurance, including homeowners and car insurance coverage, if you haven't had a claim under the policy by the time it ends, you get no refund of the premium.

Long-Term The Combination Of Whole Life And Term Insurance Is Referred To As A Family Income Policy

Some term life insurance coverage customers have been dissatisfied at this end result, so some insurance firms have developed term life with a "return of premium" function. term life insurance for couples. The costs for the insurance policy with this feature are frequently dramatically greater than for plans without it, and they usually call for that you keep the plan effective to its term or else you surrender the return of premium advantage

Degree term life insurance coverage premiums and fatality benefits stay consistent throughout the policy term. Degree term policies can last for durations such as 10, 15, 20 or three decades. Degree term life insurance policy is typically extra budget friendly as it does not develop money worth. Level term life insurance policy is among the most common sorts of security.

Comprehensive Term Life Insurance For Couples

While the names commonly are utilized reciprocally, level term protection has some vital distinctions: the premium and survivor benefit remain the exact same throughout of insurance coverage. Level term is a life insurance policy plan where the life insurance costs and survivor benefit continue to be the exact same throughout of protection.

Latest Posts

Globe Life Final Expense Insurance

Best Insurance For Funeral Expenses

Burial Insurance In Nc